What do SIREN, SIRET, APE, NAF, RCS and CFE mean? They are commonly used in France, particularly during business registrations. Let me explain.

Firstly, if you wish to carry out business in France you are obliged to register your business. It does not matter if you already own a company in another country. Failing to do so will render your business illegal and, if caught, Government sanctions will be levied.

CFE (Centre de formalités des entreprises)

When registering as a company or a self-employed entrepreneur with your CFE (Centre for Business Formalities), you would have to ask for your company’s identification number.

The CFE that you need to contact is based on your business activity and geographical situation. Your CFE office is the one that is local to your head office or to the location where you conduct the majority of your operations.

You must register with the correct CFE office within eight days of starting your business operations.

The CFE’s purpose is to simplify your administrative procedures when you establish, modify, or close your business operations.

Types of business activities

They are mainly classified into the following groups:

Types of CFE

If you are a craftsman / artisan, your CFE would be the “Chambre de Métiers et de l’artisanart”.

If you are a “commerçant” (in sales and imports/exports), your CFE would be the Chambre de Commerce et de l’industrie (Chamber of Commerce and Industry).

For the profession libérale (liberal professions such as doctors, lawyers, consultants, translators and teachers for example), your CFE would be URSSAF (acronym for “L’Union de Recouvrement des cotisations de Sécurité Sociale et d’Allocations Familiales”).

For the “agent commercial” (eg. Property agents), it would be the Greffe du Tribunal de Commerce (Commercial Court).

For people in the agricultural business, it would be the Chambre d’Agriculture

For other types of business, it is your nearest tax centre.

| Business Activity | CFE (Centre de formalités des entreprises) |

|---|---|

| Artisan / Craftsman | CMA (Chambre de métiers et de l’artisanart) |

| Commerçant /Commercial | CCI (Chambre de commerce et de l’industrie) |

| Profession libérale | URSSAF (Union pour le recouvrement des cotisations de sécurité sociale et d’allocations familiales) |

| Agent Commercial | Greffe du Tribunal de Commerce |

| Agriculteur | Chambre de l’Agriculture |

| Others | Centre des impôts |

Business Identification Numbers

Ever wondered what these numbers and letters stand for? Well, I did and found the following information which I would like to share with you.

SIRENE Directory (the National Identification System and the Directory of Businesses and their Establishments):

SIRENE is an acronym for “Système national d’identification et du répertoire des entreprises et de leurs établissements”.

It is the French directory managed by INSEE which assigns a SIREN number to businesses, organisations and associations and a SIRET to establishments/ branches of these same companies, organisations and associations.

The SIREN and SIRET numbers are given irrespective of their legal forms and sector of activity. Foreign companies that have a representation or activity in France are also listed.

Associations are not obliged to register in the SIRENE Directory unless:

SIREN (Business Directory Identification System):

It is an acronym for « système d’identification du répertoire des entreprises ».

It comprises of 9 digits, a unique identification number for each company that is used by public and private organisations.

Issuing body: INSEE (National institute of statistics and economic studies) via the CFE. INSEE is an acronym that stands for Institut national de la statistique et des études économiques.

SIRET (Business Directory Identification system for establishments /branches):

Acronym for « Système d’Identification du répertoire des établissements ».

It comprises of : 14 digits = 9 digits of the SIREN + 5 digits specific to each establishment

It identifies each establishment/branch of the same company and is used by social and tax entities.

The SIRET number must appear on employee pay slips, invoices, quotations, letter heads etc.

Issuing body: INSEE via the CFE

APE (main activity carried out) or NAF (classification of activities):

The APE code is an initialism for “activité principale exercée”, whereas the NAF code is an acronym for « nomenclature d’activités française”). They are one and the same. Each professional activity is governed by a code issued by INSEE called the APE code.

Comprises of: 4 digits + 1 letter which refers to the French national statistical classification of activities (NAF Revision 2, since 2008).

They identify the main branch of activity of a company or of a self-employed person.

APE – French business classification:

If a business has more than one activity, the breakdown of turnover or the workforce by industry is used as a criterion for determining the main activity.

Its main function is for statistical purposes.

The APE number determines the applicable trade agreement to which the company is subject to.

This number must appear on employee pay slips.

Issuing body: INSEE via the CFE.

You can make changes to your APE code. Link here.

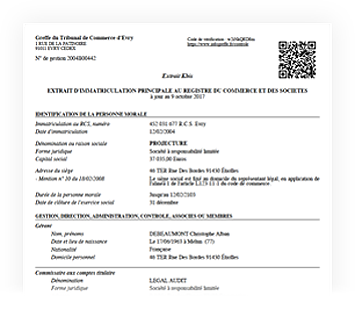

RCS (Trade and Company Register):

RCS is an abbreviation for « Registre de Commerce et des Sociétés).

For registration of traders and commercial companies.

The RCS number comprises of: RCS + City of Registry + SIREN No.

Document issued: extrait (extract) K and Kbis.

Extrait K (for a sole trader) or extrait Kbis (for companies)

confirms the business registration and allows an entrepreneur or a company to prove their legal status and registration in the Trade and Company Register (RCS). This document can be obtained free of charge via the internet by the owner of the company.

It can also be requested for by anyone seeking information about a company. Obtaining a K or a K-bis from the Commercial Court (« Greffe du Tribunal ») is payable.

What is mentioned in the K or Kbis? How do I obtain such a document? Link here.

Issuing body: Registry of the Commercial Court (Greffe du Tribunal de Commerce) via the CFE.

The document may be best described as your official business identity card but its use is being phased out from November 2021, when the use of the SIREN identification certificate from INSEE will be used.

LEI or Legal Entity Identifier:

Identities of the legal persons involved in financial markets.

Comprises of: 20-character alphanumeric code

Online procedure : link.

Issuing body: INSEE

RM (Business Directory):

RM stands for « répertoire des métiers ».

It comprises of : SIREN number + RM + numbers indicating the competent CMA (Chambre des métiers et de l’artisanart).

Craft companies employing less than 10 employees are obliged to register in the Chamber of Crafts Business Directory.

Artisans obtain a D1 certificate in lieu of the Kbis.

Issuing body: CMA via the CFE

TVA (VAT):

TVA is an bbreviation for « Taxe sur la valeur ajoutée » or VAT – value added tax.

It comprises of: FR (country code) + 2 digits + SIREN number and is a tax identification for any company liable for Value Added Tax (VAT).

The number becomes mandatory when the amount of acquisitions made in the European Union exceeds €10,000 per year or if it sells or purchases services from companies established in the EU.

However, applying for a VAT number does not mean that you will lose your VAT exempt status.

The VAT number must appear on invoices and VAT returns.

Issuing body: Corporate Tax Office (Service des Impôts des Entreprises) via the CFE.

How do you apply for a VAT number. Read here.

Decoding the Social Security Number:

Self-employed persons would use their social security numbers in the course of their business (eg. Declarating their income).

Did you know that they follow some specific rules?

The social security number corresponds to the registration number in the RNIPP (répertoire national d’identification des personnes physiques“ or national personal identification directory).

It is made up of the 13-digit NIR (“numéro d’inscription” or registration number) and a 2-digit control key.

The NIR, created from your personal civil status, is composed as follows:

1st number: gender. 1 = male 2 = female

Next 2 numbers: year of birth (eg. 90 for 1990)

Next 2 numbers: month of birth (eg. 06 for June)

Next 2 numbers: the French department where you were born or 99 if born outside France

Next 3 numbers: official INSEE code for your commune. For those born outside France, it is the country code, eg. United Kingdom is 132.

Next 3 numbers: Serial number for people born in the same place during the same period

Social security numbers are managed by INSEE.

Don’t forget your Tax Returns for 2021 income:

From 7th April onwards it is possible to submit your tax returns online or on paper format. Should you need any assistance in this field, I would be pleased to help you with this administrative formality.

However, please keep in mind that I shall be very busy from 18th April onwards and shall not take any requests after 7th April. I apologise for the inconvenience caused this year and hope that you will understand why when you shall read about the event next month or the month after. Nothing to worry about, it’s good news!

Sources:

Cover photo sourced from pexels.com (by Pixabay) – CCO

https://www.service-public.fr/particuliers/vosdroits/F33078

https://www.french-property.com/guides/france/working-in-france/starting-a-business/registration

https://entreprendre.service-public.fr/vosdroits/F31190?lang=en

https://entreprendre.service-public.fr/vosdroits/F31190

https://www.insee.fr/fr/information/2406147

https://entreprendre.service-public.fr/vosdroits/F33050?lang=en

https://entreprendre.service-public.fr/vosdroits/F21000?lang=en

https://entreprendre.service-public.fr/vosdroits/R53017?lang=en

https://entreprendre.service-public.fr/vosdroits/F23570?lang=en